Check if the total monthly tax deductions MTDPCB displayed is correct. 5 095 Income Tax Payment excluding instalment scheme 6 150 Penalty Payment For Section 103A 103.

Malaysia Personal Income Tax Relief 2022

If unsure you can check the status of the charitable organisation on LHDN website.

.png)

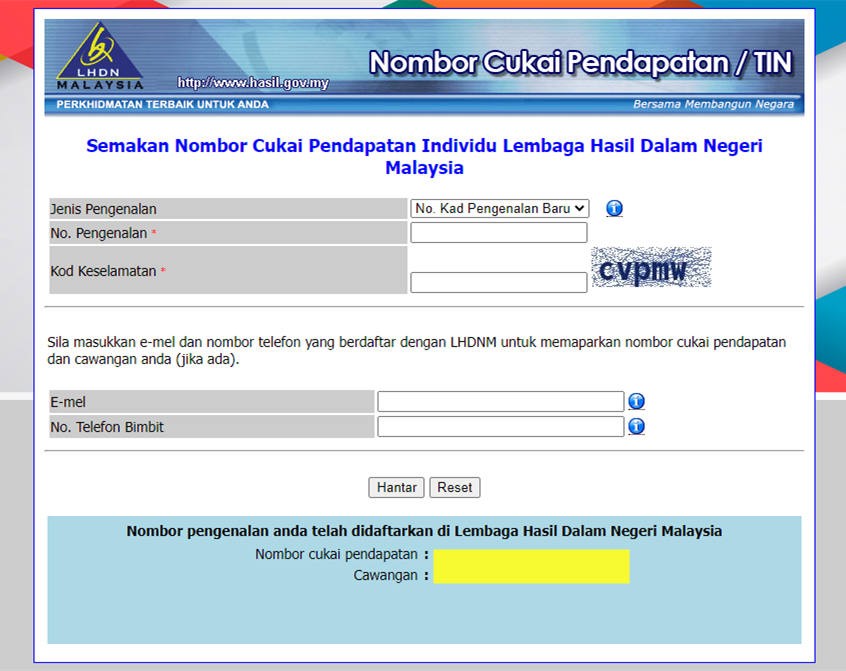

. You do not have to key in the letter C if your tax reference number contains this alphabet. What are the top benefits of Visa Platinum credit card. TAX NUMBER APPLICATION THROUGH e-Daftar Please Visit wwwhasilgovmy LHDNM.

2 ways to check SOCSO or PERKESO number. You can find this information in the EA Form provided by your company. Remember you must ensure the organisation you donate to is approved by LHDN.

As mentioned above our SOCSO or PERKESO number is our Malaysian NRIC number 12 digits without the dash. But do you know how to pay PCB through to Lembaga Hasil Dalam Negeri LHDN or the Inland Revenue Board of Malaysia IRBM. Total income tax exemptions and reliefs chargeabletaxable income.

A calculation is done to determine if you have tax to pay or are indeed eligible for a rebate. Individual Income Tax Return electronically with tax filing software to amend tax year 2019 or later Forms 1040 and 1040-SR. Make sure to get your handphone number down correctly as LHDN will send you a TAC when you sign and submit your e-form and your bank account number must also be accurate if you want to get your tax refund.

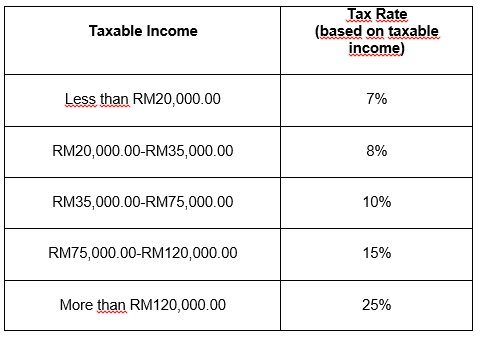

It is stated on the SOCSO FAQ website that the SOCSO number is Malaysia NRIC number. Your tax rate is calculated based on your taxable income. Other income is taxed at a rate of 30.

Tax rebate for Self. Kindly remember to attach Income Tax Number latest address and a copy of National Registration Card MyKad. LAPORKAN PENDAPATAN TAHUN TAKSIRAN 2021 SELEWAT-LEWATNYA PADA 15 MEI 2022 DAN ELAK PENALTI LEWAT KEMUKA BORANG NYATA CUKAI.

Instead add a 0 at the end of your tax reference number and make sure that your reference number contains 11 digits. You will earn 5x points for dining department store purchases and overseas spend plus 5000 bonus points monthly when you spend RM1500 or. Cash advances cash withdrawals charges for cash advance or cash withdrawals annual fees interest finance charges late payments fees disputed transactions or any other form of service or miscellaneous fees charged by us.

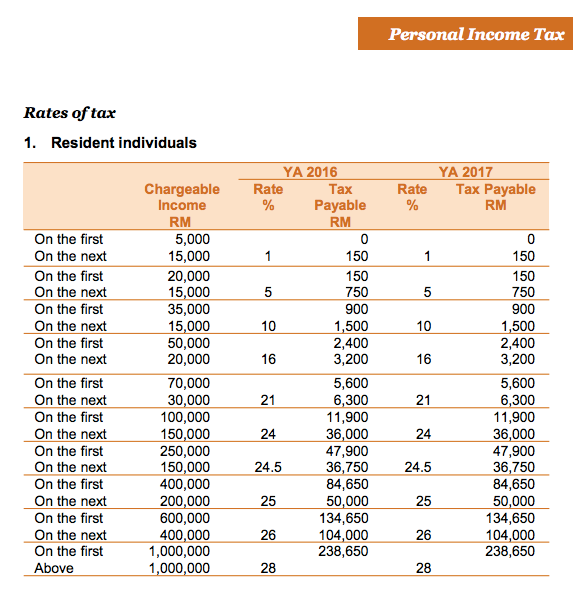

After all if you as an employer fail to deduct andor remit payment by the 15th of the following month you can be fined RM 200 20000 or given 6 months imprisonment or both. Personal Income tax is payable on the taxable income of residents at the progressive rates from 0 to 30 with effective Year of Assessment 2020. Once you have filed all the relevant tax amounts charged on your chargeable income.

The most important thing is you will get a faster refund in case you paid excess income tax through PCB. Number Or visit to nearest LHDN Branches. You may refer to the screenshot from SOCSO FAQ on the SOCSO registration number.

Lembaga Hasil Dalam Negeri Malaysia HASiL ingin memberikan peringatan kepada semua pembayar cukai yang tidak menjalankan perniagaan agar segera melaporkan pendapatan mereka yang layak. E-Daftar is an income tax file registration system for new tax payer to get their income tax file number. LHDNs CIMB account 800 766 957 is no longer in use.

Also LHDN extended the dateline for extra 2 weeks. You must pay income tax on all types of income including income from your business or profession employment dividends interest discounts rent royalties premiums pensions annuities and others. Basically it is a tax return form informing the IRB LHDN of the list of employee income information and number of employees it must be submitted by March 31 of each year.

You can file Form 1040-X Amended US. Nonresidents are subject to withholding taxes on certain types of income. A tax rebate reduces the amount of tax charged there are currently four types of tax rebates for income tax Malaysia YA 2021.

Individual Income Tax Return Frequently Asked Questions for more information. The minimum income requirement of RM36000 per annum. See Form 1040-X Amended US.

You must be above 21 years old and the minimum annual income requirement is RM36K. This is the most important step to carry out. Per LHDNs website these are the tax rates for the 2021 tax year.

Any individual earning more than RM34000 per annum or roughly RM283333 per month after EPF deductions has to register a tax file. You may obtain your supporting document by emailing WHToperasihasilgovmy. Have you register for ezHASiL e-Filing.

Additionally you now have the option to choose DuitNow as your preferred payment method for tax refunds. Income Tax File Registration. Retail purchase excludes the following transactions.

Submission of e-Daftar supporting documents can also be made via our e-daftar. Please ensure you have submitted your e-Daftar application before submitting the supporting documents using the feedback form. Just be sure to select Payment.

So the more taxable income you earn the higher the tax youll be paying. Residents and non-residents are subject to tax on Malaysian-source income only. Types of e-Filing user New User First Time User need to register Digital.

Form E Borang E is a form that an employer must complete and submit to the Internal Revenue Board of Malaysia IBRM or Lembaga Hasil Dalam Negeri LHDN.

Iincametaxncome Tax Lhdn Filing Taxes Income Tax Tax Guide

How To Check Income Tax Refund Status Online Malaysia Perjalanan Dan Wisata Di Indonesia

6 Income Tax Faq 大马个人所得税需知 Income Tax Income Tax Return Online Taxes

Solved In Doing An Income Tax Calculation Lhdn Was Given Chegg Com

Will Section 106a Let Lhdn Access Your Bank Accounts Tech Arp

How To Check Your Income Tax Number And Tax Identification Number Leh Leo Radio News

A Step By Step Guide To File Income Tax Online

How To File Your Taxes For The First Time

Filing Income Taxes In Malaysia Mystery Solved By Other Expats Medium

.png)

How To Check Your Income Tax Number

Finance Malaysia Blogspot Tax Refund Email Sent By Lhdn So Good Ah

Steps To Apply E Pin Online L Co

Here S A How To Guide File Your Income Tax Online Lhdn In Malaysia

Income Tax Of An Individual Lembaga Hasil Dalam Negeri

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

Filing Income Taxes In Malaysia Mystery Solved By Other Expats Medium

Lhdn Issued An Steve Ting Accounting Nf 1926 Facebook

How To Declare Your Rental Income For Lhdn 2021 Speedhome Guide